In this exclusive White Paper, Egil Juliussen from VSI Labs guides us through what to expect for the future of ADAS. Focusing on AEB and covering major regulation benchmarks, the Paper is a summary of the NPRM mandate including NHTSA's rationale, key features, testing requirements, cost and benefits, and likely deployment time.

The advanced driver assist system (ADAS) industry is starting to make a big impact on automotive safety and is on a path to becoming a crucial technology for lowering many types of vehicle crashes. ADAS has many different products with multiple technologies, sensors, systems, use-cases, and user interfaces.

The U.S. has been cautious in introducing ADAS regulation and adding ADAS features to its New Car Assessment Program (NCAP)—at least compared to European efforts. It looks like the National Highway Traffic Safety Administration (NHTSA)—the U.S. automotive safety regulator agency is now serious about getting specific ADAS features added to NCAP and as safety regulation for all light vehicles.

This white paper will discuss NHTSA’s past effort and history to understand the acceleration of current ADAS activities. NHTSA’s recent publication of a Notice of Proposed Rulemaking (NPRM) is a major regulation step that will mandate Automatic Emergency Braking (AEB) for both forward collisions and pedestrians.

ADAS Acronyms

This white paper uses many regulatory, ADAS and related acronyms and a list is provided in the next table.

Acronym | Acronym Meaning | Acronym | Acronym Meaning |

AEB | Automatic Emergency Braking | FCW | Forward Collision Warning |

ADAS | Advanced Driver Assist System | FMVSS | Federal Motor Vehicle Safety Standard |

BIL | Bipartisan Infrastructure Law | ISA | Intelligent Speed Assist |

BSD | Blind Spot Detection | LCA | Lane Centering Assist |

BSI | Blind Spot Intervention | LCA | Lane Change Assist |

BSW/M | Blind Spot Warning/Monitoring | LDW | Lane Departure Warning |

CAS | Collision Avoidance System | LKA | Lane Keep Assist |

CIB | Crash Imminent Braking | MY | Model Year |

CTA | Cross Traffic Alert | NCAP | New Car Assessment Program |

DBS | Dynamic Brake Support | NHTSA | National Highway Traffic Safety Administration |

DMS | Driver Monitoring System | NRPM | Notice of Proposed Rulemaking |

DUI | Driving Under the Influence | PAEB | Pedestrian AEB |

ESC | Electronic Stability Control | RFC | Request for Comment |

FARS | Fatality Analysis Reporting System | VRU | Vulnerable Road Users |

Source: VSI Labs, July 2023

Why is this important?

AEB is now the most important ADAS product in the U.S. On May 31, 2023, NHTSA announced it is adding both AEB and Pedestrian AEB to NCAP and as FMVSS regulation. NHTSA is doing this because of AEB’s potential to prevent many fatalities and mitigate many non-fatal injuries. This proposed mandate is the most important and most impactful ADAS rulemaking NHTSA has ever done.

The AEB mandate will grow the sensor market opportunity due to improved sensor requirements. Better cameras will be used for low light operation with a large infrared camera opportunity emerging. Radars may see a lift too with emerging 4D-imaging. Solid state lidar may also see greater ADAS opportunity with the AEB mandate. This is all good news for the ADAS sensor suppliers.

What has NHTSA done in ADAS?

NHTSA has researched ADAS technology for nearly 30 years with a focus on front-end collisions. The next table is a summary of NHTSA’s growing ADAS activities.

- NHTSA released multiple collision avoidance reports in the late 1990s and 2000s. This research gave NHTSA technology knowledge about FCW systems and vehicle crash avoidance scenarios where FCW systems could play an effective role in alerting drivers to brake and avoid crashes. In 2009, NHTSA leveraged this research in the development and conduct of controlled track test assessments on three vehicles equipped with FCW. This prepared NHTSA to start adding ADAS technologies to NCAP ratings and testing.

NHTSA’s ADAS & NCAP Activities | ||

| Key Information | Other Information |

1990s & 2000s | · NHTSA research on CAS & FCW | · Multiple CAS reports: 1999, 2000, 2007 |

2007 | · RFC on FCW, LDW & ESC | · First RFC for ADAS technology |

2009 | · Track testing of FCW vehicles | · Developed and tested by NHTSA |

MY 2011 | · NCAP recommendation: FCW, LDW & ESC | · ESC became a mandate for MY 2012 |

2010s | · CIB & DBS research; 2012 report | · CIB & DBS is equivalent to AEB |

MY 2014-18 | · Rear backup video: Recommended | · Mandate for MY 2018 |

Nov 2015 | · Recommended AEB or CIB-DBS | · AEB for frontal collisions |

Dec 2015 | · RFC on AEB, BSD & FCW | · Key report for growing ADAS & NCAP |

2016 | · AEB voluntary agreement: most OEMs | · Most OEMs agree to add AEB by 2022 |

MY 2018 | · NCAP assessment: AEB or CIB-DBS | · Included AEB testing for NCAP points |

Spring 2021 | · Announced FMVSS intention on AEB | · Part of Unified Regulation Agenda |

March 2022 | · RFC on ADAS & NCAP expansion | · Including 10-year ADAS roadmap |

May 2023 | · FMVSS: FCW, AEB & PAEB | · 3- or 4-years after final rule published |

Source: VSI Labs, July 2023

- For MY 2011, NHTSA recommended FCW, LDW and ESC for points in the NCAP ratings. ESC became a mandate for MY 2012.

- NHTSA recommended rear backup video for NCAP ratings starting in MY 2014. It became a mandate in MY 2018.

- In November 2015, NHTSA recommended AEB for extra points in the NCAP ratings.

- NHTSA released an important RFC in December 2015 that focused on ADAS technologies and their role in NCAP and future regulation impact. The first result came in MY 2018 when NHTSA recommended AEB including testing its capabilities. This only included frontal collisions, which is often called lead vehicle crashes.

- In 2016, NHTSA made a voluntary agreement with most auto OEMs to include AEB in all light vehicles sold by 2022. This was very successful and over 90% of vehicles sold in 2022 had AEB.

- NHTSA announced its intention to make AEB a mandate as a FMVSS in the Spring of 2021.

- In March 2022, NHTSA released its most important RFC with extensive information and future plans on ADAS technology. The RFC had 236 pages and included a 10-year roadmap for ADAS, NCAP and future rating systems. The report also discusses ADAS technologies for safe driving choices such as driver monitoring systems (DMS), driver distraction, alcohol detection, intelligent speed assist (ISA) and seat belt interlock. The report is available at: https://www.nhtsa.gov/sites/nhtsa.gov/files/2022-03/NCAP-ADAS-RFC-03-03-2022-web.pdf

- In May 2023, the first result of the 2022 RFC was announced with a mandate for FCW, AEB and pedestrian AEB. The NHTSA mandate document is available at: https://www.nhtsa.gov/sites/nhtsa.gov/files/2023-05/AEB-NPRM-Web-Version-05-31-2023.pdf

It has taken a while for NHTSA to add a strong ADAS mandate, but it is now moving fast with more ADAS features likely to be added.

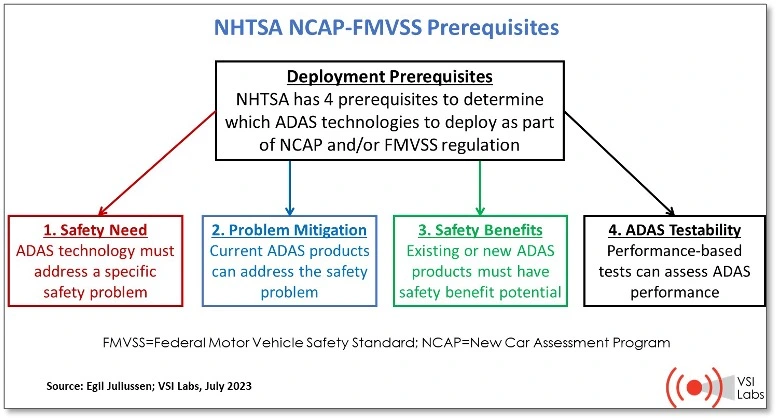

What are NHTSA’s criteria for adding ADAS?

NHTSA has a charter to lower vehicle crashes and reduce their medical and economic impact in the U.S. To accomplish this goal with ADAS technology, NHTSA has a procedure. NHTSA has four prerequisites for determining which ADAS technology to deploy as part of NCAP or FMVSS. The next figure summarizes the procedure.

To identify the safety need, NHTSA makes a comprehensive analysis of its detailed database of vehicle crash data. The database goes back to at least 1966 with increasing details in the last 25 years. This includes sorting crashes by major groups such as forward collisions, lane departure crashes, pedestrian crashes, collisions due to blind spots, intersection crashes and cross-traffic crashes. NHTSA has detailed statistics on many crash types and use that as guideline for the safety need.

NHTSA’s analysis of the AEB safety need focused on the calendar year 2019 crash data because it is the most recent year without the effect of the Covid pandemic. Much of the data comes from the Fatality Analysis Reporting System (FARS), which is a nationwide census providing annual data on fatal injuries in vehicle crashes. FARS data is available here: https://www.nhtsa.gov/research-data/fatality-analysis-reporting-system-fars

The ADAS mitigation analysis relied on NHTSA’s extensive research and testing of ADAS systems summarized in the previous section. NHTSA also cooperates with and/or uses data from Insurance Institute for Highway Safety (IIHS), Consumer Reports and other organizations that rate and/or test ADAS vehicles. IIHS has especially good perspectives on the positive impact of AEB through its auto insurance members.

Assessment of the safety benefits also leveraged NHTSA’s ADAS and NCAP research, testing and related activities. This includes sensor abilities, ADAS software and hardware capabilities and cost—plus future technology improvements from innovations and inventions.

Cost-benefit analysis is standard procedure for all NHTSA mandates, and it has long experience in modeling estimated costs and benefits. The auto industry is likely to add their own perspectives on cost-benefits—especially in regard to the costs that the auto industry must pay when the mandate starts.

ADAS testability relies on multiple sources and expertise. The sharp increase of AEB-equipped vehicles has allowed NHTSA and many other organizations to test and rank ADAS-equipped vehicle. NHTSA has done extensive ADAS testing with AEB receiving the most attention. As part of the AEB-PAEB proposal NHTSA published a detailed report on the testing required for the new mandate—with a page-count exceeding 750 pages. The publication is available at: https://downloads.regulations.gov/NHTSA-2023-0021-0004/attachment_2.pdf. A shorter summary version (113-pages) is available at: https://downloads.regulations.gov/NHTSA-2023-0021-0006/attachment_2.pdf

How AEB solves part of Safety Problems

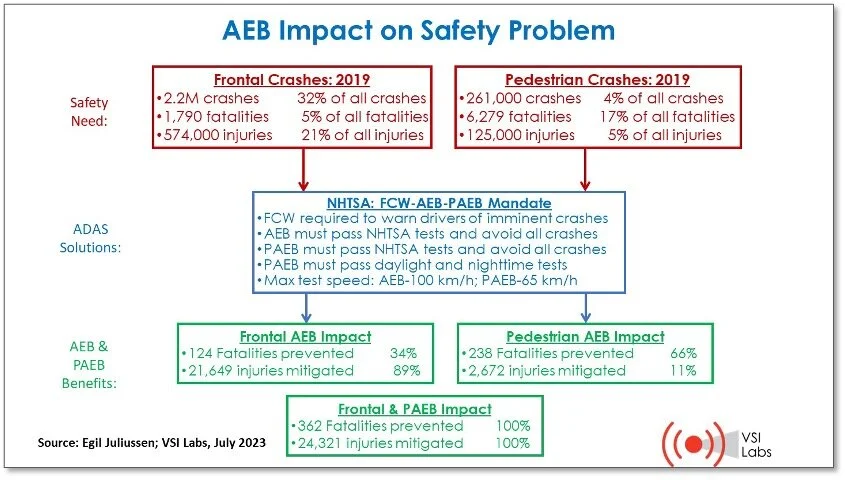

NHTSA proposed the AEB mandate to lower the number of two types of crashes—frontal crashes and pedestrian collisions. The frontal crash category is the most prevalent vehicle crash type. Pedestrian crashes are one of the most concerning and urgent traffic safety problems—the rapidly increasing numbers of pedestrian fatalities and injuries.

Pedestrian crashes are often deadly and have been increasing in recent years. They frequently happen at night and at higher speeds. About half of fatal pedestrian crashes happen on roads with a speed limit of 40 mph or lower and half on roads with a speed limit of 45 mph and higher.

The next figure recaps how AEB including pedestrian AEB can solve part of the vehicle crash problem. The top red blocks show the safety need for frontal crashes and pedestrian crashes. Frontal crashes accounted for 32% of total crashes in 2019, 5% of all fatalities and 21% of all injuries. Note that frontal crashes reached 2.2 million in 2019 in the U.S.

Pedestrian crashes were only 4% of all crashes and 5% of all injuries in 2019. The big problem is that pedestrian fatalities were 17% of all vehicle crash deaths—or 6,279 lives lost.

The ADAS solution that NHTSA is proposing is summarized in the blue box. NHTSA is proposing to include three ADAS features in its mandate—FCW, AEB and PAEB. FCW is required to alert the driver of any impending collision with a forward obstacle. Frontal AEB and pedestrian AEB is necessary to lower fatalities and mitigate injuries.

The key to both frontal and pedestrian AEB is that vehicles must pass all NHTSA specified testing without hitting the front vehicle or a pedestrian. The testing requirements are much tougher than the current voluntary AEB systems. Another major improvement is that pedestrian AEB has to be tested in daylight and night lighting conditions. These testing requirements will make future AEB systems much better in avoiding frontal and pedestrian crashes than current voluntary frontal AEB systems.

The result will greatly increase the benefit of future AEB-PAEB vehicles—especially as the AEB-PAEB parc or vehicles in-use grows in the next decade or so. By end of 2035 the U.S. could have 120 million to 140 million of AEB-PAEB equipped vehicles.

NHTSA has specified crash avoidance requirement for all AEB testing conditions. This does not mean that frontal and pedestrian crash avoidance will happen in all traffic and driving conditions. The testing technology is not safe enough to test the AEB systems at all legal speed limits. PAEB is tested up to 65 km/h or 40.4 mph. Frontal AEB is tested up to 100 km/h or 62.2 mph.

NHTSA’s projected benefits for the AEB-PAEB mandate are listed in the green boxes. A total of 362 lives saved is projected per year with PAEB accounting for 66% or 238 fatalities prevented. Frontal AEB will have the most injuries mitigated at 89% of the total 24,321 injuries mitigated. NHTSA believes these benefit estimates are low.

What are the yearly AEB-PAEB vehicle costs?

The estimated cost for adding FCW-AEB-PAEB to the vehicles are part of the NHTSA’s cost-benefit analysis. NHTSA’s estimate of per vehicle cost and total annual costs are shown in the next table. VSI Labs have some questions on the NHTSA’s cost estimates.

AEB-PAEB Mandate: Annual Vehicle Costs | ||||

Light Vehicle Sales: Yearly Average: 2011-2020 | Per Vehicle Cost | Total Annual Costs (Millions) | ||

Category | Sales (000) | Design Cycle | Annual | |

Cars | 6,257 | $82.15 | $27.38 | $171.32 |

Light trucks | 9,445 | $11.74 | $110.84 | |

Total | 15,701 | – | $17.97 | $282.16 |

Data Source: NHTSA; Table by VSI Labs, July 2023

NHTSA believes there will only be software costs added per car. This is NHTSA’s statement on costs in the FMVSS document:

“Because common hardware is used across lead vehicle AEB and PAEB systems, specific system functionality can be achieved through upgraded software. Therefore, the incremental cost associated with this proposed rule reflects the cost of a software upgrade that would allow current systems to achieve lead vehicle AEB and PAEB functionality that meets the requirements specified in the proposed rule. The incremental cost per vehicle is estimated at $82.15 for each design cycle change of the model. When accounting for design cycles and annual sales of new light vehicles, the total annual cost associated with the proposed rule is approximately $282.2 million in 2020 dollars”.

The $282.2 million-figure is an average of $17.97 per vehicle with NHTSA assuming a sales volume of 15.7 million units per year.

Our question is about the design-cycle cost. The design-cycle cost of $82.15 per vehicle is not included in the cost estimates. We believe design-cycle cost is the software development cost. It is possible that some part of the software development cost should be included on a yearly basis because software is updated every 3-4 years as part of the auto model update cycle. Maybe some regular software maintenance costs should also be included.

What is the AEB-PAEB mandate deployment timeline?

With every NHTSA FMVSS-based mandate there is some timing uncertainties. There is a 60-days comment period for the auto industry and other interested parties, which could be extended. NHTSA may need time to update the proposal based on comments, which could add more time until the final ruling is published.

If the final FMVSS rule is published by the end of August 2023, most of the AEB-PAEB features will be required by Model-Year 2027, which starts September 1, 2026. The most stringent testing features are mandated for one year later or MY 2028. If NHTSA’s final rule is published later in 2023 or before September 2024, the mandate deployment is delayed another year—MY 2028 and MY 2029.

NHTSA is hoping to get a voluntary agreement with most auto OEMs for early deployment of the AEB-PAEB mandate. This was very successful for the first AEB recommendation and there is a good chance it will happen again. Many OEMs have come a long way in advancing ADAS technology and could implement AEB-PAEB quicker than the mandate timeline.

Cost and benefit summary

NHTSA provided an economic cost-benefit analysis of the AEB-PAEB mandate. NHTSA’s cost benefits include estimates of the monetary value of a person’s life. The value of life is an economic value used to quantify the benefit of avoiding a fatality. Estimates for the value of a life are used to compare the lifesaving and risk-reduction benefits of new policies, regulations and related activities. When calculating the value of life, it is important to discount and adjust it for inflation and real income growth over the years. NHTSA is using two discounts, 3% and 7% to show a range. Wikipedia has much additional information if needed: https://en.wikipedia.org/wiki/Value_of_life

NHTSA’s cost-benefit analysis of the AEB-PAEB mandate shows it is very cost effective as summarized in the next table. NHTSA’s FMVSS proposal has many more details on how the benefits and costs are calculated.

AEB-PAEB Mandate: Cost and Benefit Summary | |||||||

Benefits | Monetized Benefits (Millions) | Total Cost (Millions) | Cost per Equivalent Life Saved (Millions) | Net Benefits (Millions) | |||

Equivalent Facilities | 3% | 7% | – | 3% | 7% | 3% | 7% |

675 | $6,802 | $5,518 | 282.16 | $0.50 | $0.62 | $6,520 | $5,235 |

Data Source: NHTSA; Table by VSI Labs, July 2023

The table shows when discounted at 3% and 7%, the cost per equivalent life saved under the proposed rule ranges from $0.50 to $0.62 million. Because the cost per equivalent life saved is less than the comprehensive economic cost of a fatality, the proposed rule is considered to be cost-effective. The net benefits from the proposed rule are estimated at approximately $6.52 and $5.24 billion, respectively. Positive net benefits indicate that the proposed rule generates a net benefit to society.

What is next for NHTSA and ADAS?

NHTSA has already outlined it future direction for ADAS in its March 2022 RFC report that was identifies in an earlier section. Looking at NHTSA’s four prerequisites for determining which ADAS technology to deploy, provide good clues to what ADAS products are likely to appear next. The most important factor is to identify which crash types have high fatality and injury rates. The next key element is which ADAS segment is mature enough to lower crash rates and have proven test procedures.

Based on these factors, VSI thinks the next table is a likely list of what is on NHTSA’s direction of future ADAS features in NCAP and/or FMVSS regulation. In the safety need column, the percentage are shares of the category’s total. The percentages may surpass 100% because some collision segments fall in multiple categories. An example is intersection crashes which overlaps with many other crash types such as frontal and pedestrian crashes. Risky driving behavior crash fatalities overlap within the categories such as DUI and speeding in the same crash. Risky driving behavior also overlap with other crash types.

Next for NHTSA and ADAS | ||

ADAS Type | Safety Need: Share of Total | ADAS Maturity |

LDW-LKA-LCA | · Crashes: 20%; Fatalities: 40%; Injuries: 17% | · Likely to meet deployment prerequisites |

BSD-BSW-BSI | · Crashes: 9%; Fatalities: 2%; Injuries: 7% | · Likely to meet deployment prerequisites |

Intersection | · Crashes: 57%; Fatalities: 28%; Injuries: 58% | · ADAS tech is emerging |

Risky driving behavior | · DUI driving: Fatalities: 39% · Distracted driving: Fatalities: 29% · Speeding: Fatalities: 27% · Un-belted seat-belts: Fatalities: 6% | · Alcohol detection is available · DMS tech is available · ISA is available · Seat-belt interlock tech is available |

Source: VSI Labs, July 2023

From the above table it looks like the lane-safety ADAS segment, LDW-LKA-LCA, is the next focus for NHTSA. It is the highest fatality segment and among the highest crash rate sector. LDW is a commonly used technology with LKA and LCA growing in popularity. Lane safety testing is also in good shape.

Blind spot solution for multi-lane roads is probably the next NHTSA ADAS candidate. The safety need is not as urgent, but ADAS features have been available for many years. There is also a significant solution overlap with lane-safety.

Intersection crashes is a different way of classifying crashes, and it includes some of the crashes that are targeted by AEB-PAEB, LDW-LKA-LCA and BSW-BSI. ADAS technology for intersection crashes is emerging but has a way to go.

NHTSA is definitely focused on risky driving behavior since they have such high fatality rates. Note that multiple risky driving behavior is included in many crashes. Driver monitoring system is already being addressed to some extent, but much better DMS systems with strong testing procedures are needed.

ADAS technology for speeding and DUI prevention are available and are seeing growing use in Europe. Intelligent Speed Adaptation (ISA) is available as a warning system or as a system that manages the vehicle speed.

Perspectives and Takeaways

NHTSA’s AEB-PAEB mandate is the most important ADAS technology deployment we have seen. It has aggressive testing requirements that will provide vehicles with growing life-saving and injury mitigating technologies. NHTSA is likely to succeed in getting early voluntary AEB deployment from many auto OEMs.

The AEB-PAEB features are comprehensive and are much more advanced than the current voluntary AEB that is only active for frontal crashes. A major change is that the AEB testing specifies crash avoidance—not just crash mitigation. The mandate requires that pedestrian AEB work in both daytime and night-time crashes. The AEB testing also increases test speeds that includes the speed where most frontal and pedestrian crashes occurs. Test speed is up to 100 km/h for frontal collisions and up to 65 km/h for pedestrian crashes.

NHTSA’s estimated benefits of the AEB-PAEB mandate are excellent. Yearly fatalities prevented is 362 with 66% coming from PAEB. Yearly non-fatal injuries mitigated are projected at over 24,300 with frontal AEB accounting for 89%. NHTSA believes these estimates are conservative.

The AEB mandate will heighten the frontal sensor requirements for better pedestrian detection and prediction capabilities. Infrared technologies are a likely candidate because of proven performance advantages—especially in low light conditions. Radars may also see greater adoption with 4D-imaging sensors. Lower cost, solid state lidar may also see increased demand with the AEB mandate. In other words—great news for the ADAS sensor suppliers!

NHTSA’s AEB mandate is probably the first major ADAS activity with more to come in the next decade.

Conditions of this report

While every effort has been made to ensure the quality and accuracy of the information provided, Vision Systems Intelligence LLC (VSI), its personnel, agents, or representatives, assume no responsibility as to the accuracy or completeness of and, to the extent permitted by law, shall not be liable for any errors or omissions or any loss, damage, or expense incurred by reliance on any information or statement contained herein.

VSI makes no warranty, expressed or implied, as to the accuracy, completeness, or timeliness of any information in this document, and shall not in any way be liable to any recipient for any inaccuracies or omissions.