For the past half a century, the automotive industry has been at the pinnacle of success in developing lean principles that every other industry emulates their manufacturing processes after. The fathers of the Toyota production system, five lean principles, and seven wastes concept were Sakichi Toyoda, his sons (Kiichiro Toyoda and Eiji Toyoda), as well as Taiichi Ohno, a manufacturing engineer. These systems and approaches shaped much of the manufacturing industry today and serve as the roots of lean from the major Japanese automotive company.

However, as the aerospace and defense (A&D) industry continues to evolve with more highly interactive and complex autonomous products, what could the automotive industry learn from A&D? In this article, I will breakdown 3 key ways that the automotive industry could learn from massive breakthroughs in A&D industry.

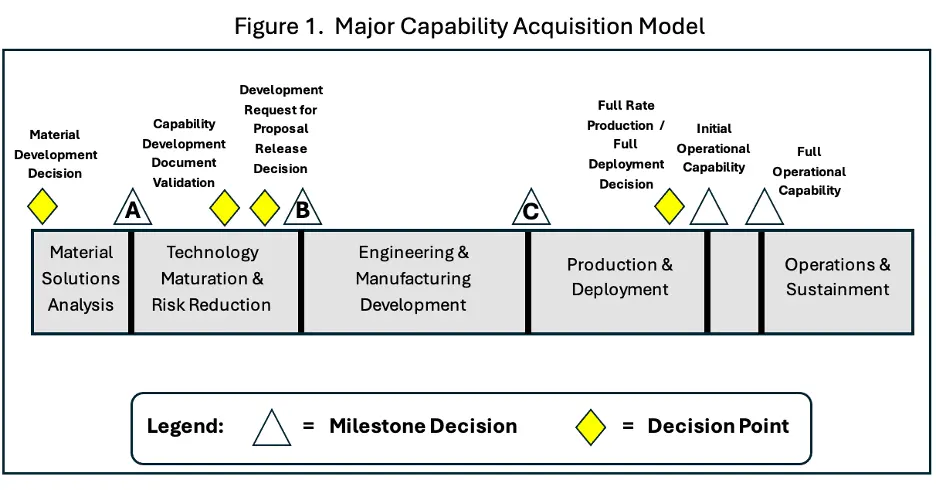

The first approach centers around the iterative project management process and how gaining customer buy-in on the final product is key for a successful role out. The aerospace industry follows Defense Acquisition University’s (DAU) major capability acquisition process (Figure 1) because of the high dollar value and complexity of the products manufactured. Unlike automotive, A&D needs to take a methodical approach for new development programs due to the customer demand for these products are much lower than those of the automotive industry. For reference, it is estimated that ~150,000 cars are made daily versus 150 F-35 fighter jets are made annually. As the urban city 2.0 infrastructure starts to take shape with more autonomous drones, vehicles, and public transport, automotive would benefit from this key insight into the capability acquisition process as much more complex vehicles, technology and software are being integrated and introduced to the public.

The second concept that is a key learning point for the automotive industry is the level of redundancies that A&D products operate with. For instance, on a commercial airplane, all major systems or components that are necessary to flight are at least triple redundant. This is mainly due to the integrated risk during air travel and incorporating redundancy enables multiple backup parts or functions that can take over in case of a failure or malfunction. With the slow rise of manufacturing fully autonomous cars, multiple redundancies will be necessary to increase customer trust in utilizing these vehicles based on previous safety protocols. Currently, about ~90% of all road accidents are down to human error. Safety will be a major element of laws, regulations, and policies introduced for widescale use of fully autonomous cars.

A well known fact within the A&D industry is that their professionals work on complex technical projects like designing and building aircraft, autonomous vehicles, satellites and space exploration platforms. Equally true is that this industry has one of the most highly technical and complex ecosystems to navigate to execute successful programs. The complex ecosystem is the final theory that automotive can learn from and is comprised of the environment, customers, suppliers and products. Each has its own unique problems and decisions that must be made. From an environment perspective, maneuvering through classified and foreign object debris (FOD) critical spaces presents individuals with challenges communicating cleared information with program teams so that information is not compromised resulting in national security issues. From a customer standpoint, the commercial customer market for automotive manufactures will be key but government customers (i.e. public transit, Department of Defense, etc.) may become more of a factor with increased use of highly technological autonomous assets. A&D has been able to excel with government customers and has developed strategic relationship with the right personnel for future pathways for new products and funding. With suppliers, it should be noted that with the increased outsourcing of high value components, there will be a need to navigate those unique supplier relationships similar to the A&D industry. The perspective surrounding the products means that managing the program lifecycle of such high value assets requires a different style that the A&D industry has mastered and is something that should viewed as best practice.

As autonomous products gain more popularity and complexity daily, the automotive industry would be wise to emulate these three major practices and concepts that the A&D industry has become well known for over the years. In my opinion, there is much to learn from the A&D industry in bringing to market high value, technical assets for a wide variety of customers, both government and commercial. Exploring the iterative nature of low rate production aircraft/platforms, building in multiple levels of redundant systems, and navigating the complex ecosystem surrounding technical products summarize a few of great strides the A&D has made in the world. I look forward to seeing what the future will bring both the automotive and A&D industries as technology advances will start to have them both merge or overlap on the latest autonomous products that will be able in the near future.

Don’t miss key conversations at AutoSens USA this May. Get your pass here.

Want to hear more?

Subscribe to Robert’s newsletter, ‘Autonomous Platforms of the Future’.

Check out Robert’s podcast ‘Brothers in Aerospace and Defence‘ – delving deep into the world of aerospace and defense with a unique perspective.

About Robert Wesley

Supplier Program Manager at Boeing Defence, Space & Security

Robert “Rob” Wesley Jr. is a Supplier Program Manager (SPM) for Boeing Defense, Space & Security (BDS) supporting the BDS Core Contracting organization. In this role, he leads the supply chain execution, business strategy, and stakeholder engagement of $1.3B supplier spend for Boeing programs portfolio to fulfill customer needs. Prior to joining Boeing in 2018, he spent seven years with United Technologies Corporations (UTC) where he held several positions of increasing responsibility across all their business units. Robert obtained his Bachelor’s degree in Mechanical Engineering and MBA in Supply Chain Management and Marketing from Howard University.

Robert not only dedicates his time to his profession, but also is passionate about the progression of minorities within the Science, Technology, Engineering and Math (STEM) fields